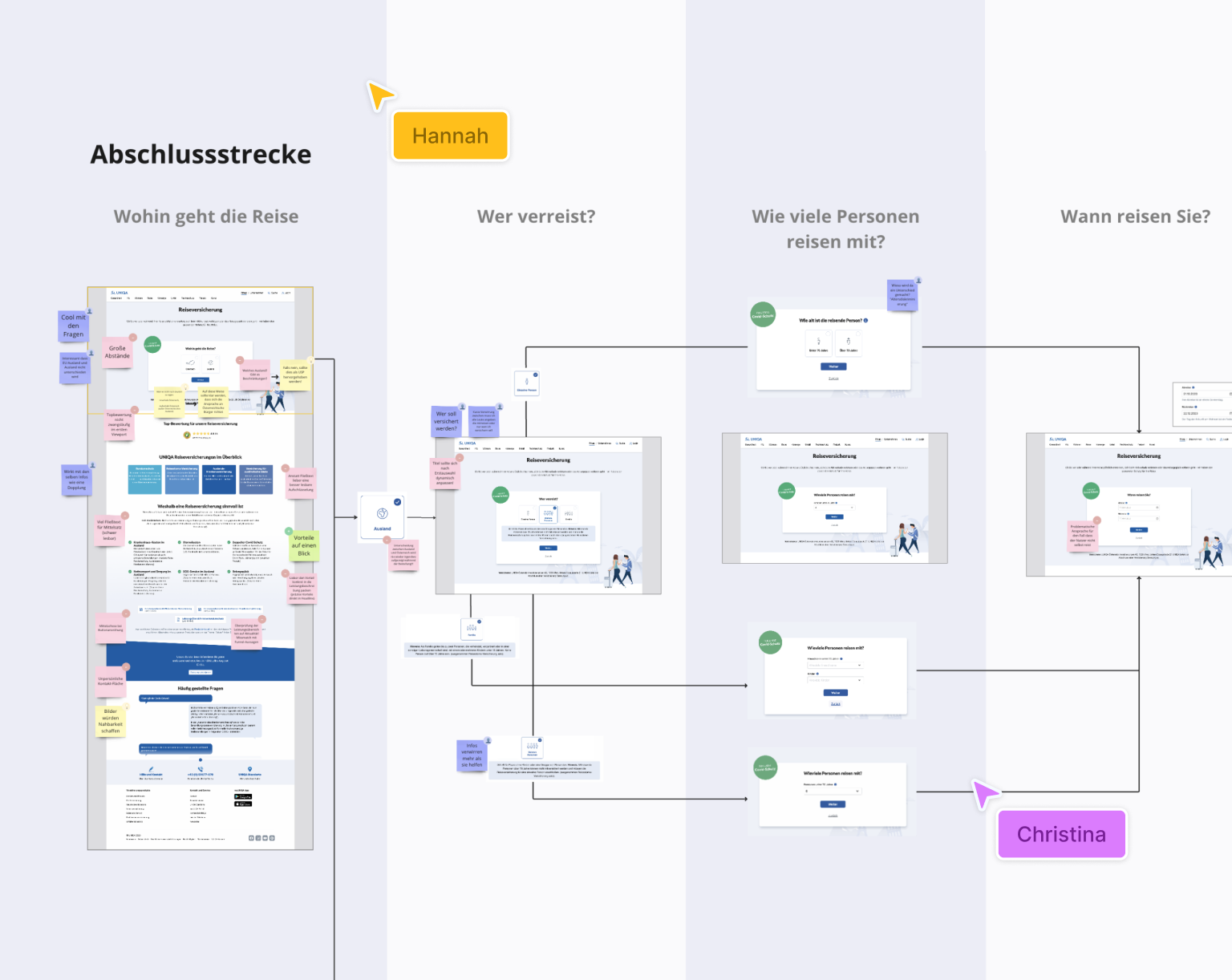

Innovative Page Development

Discovering and prioritizing areas of opportunity

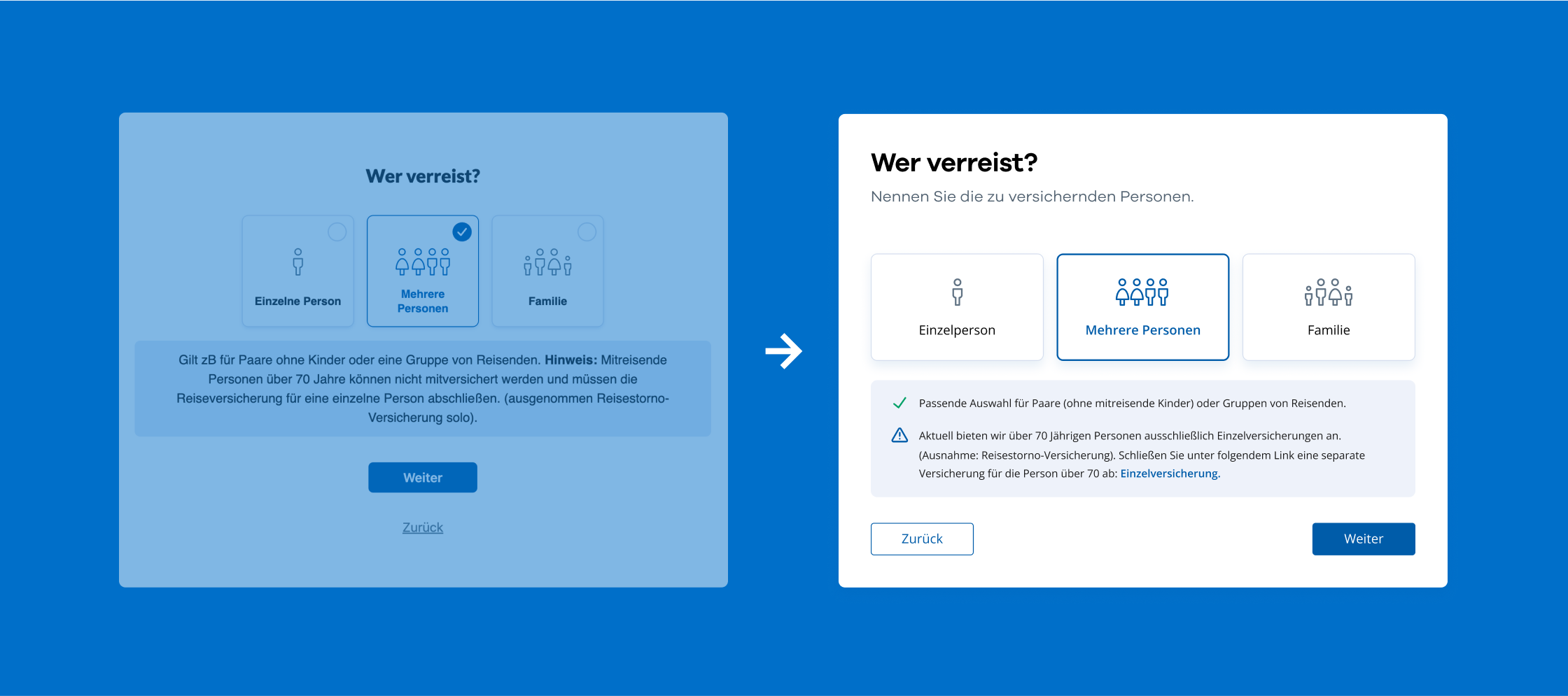

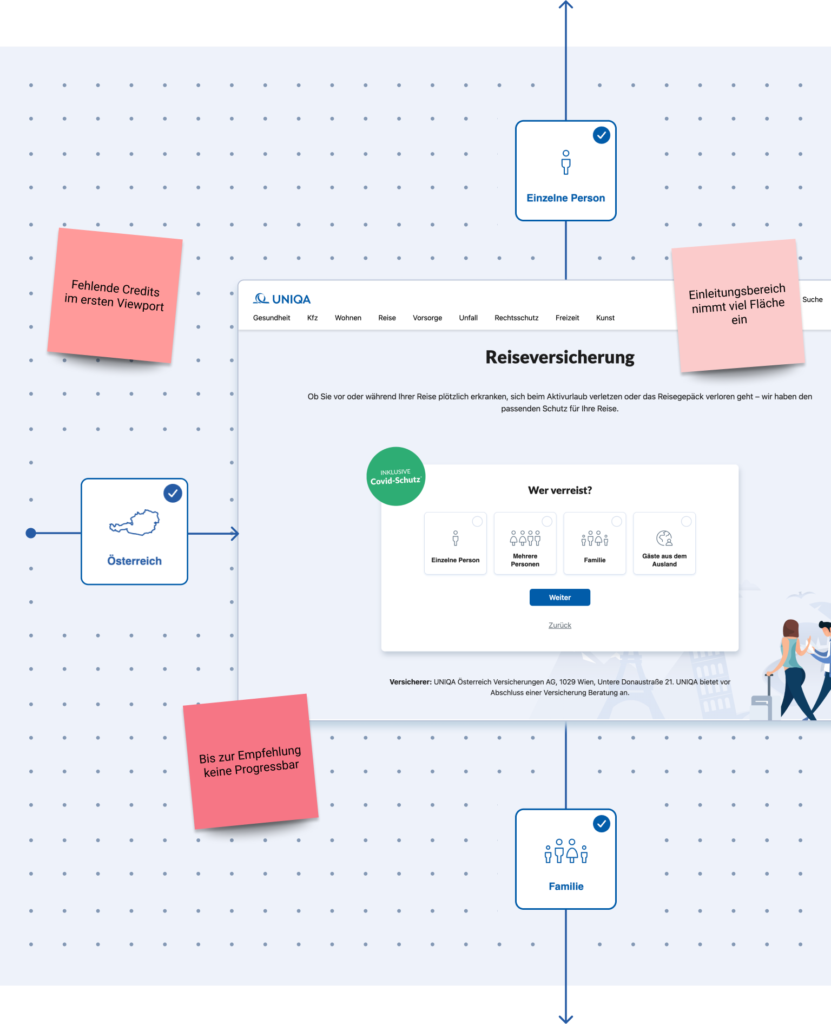

Key findings included:

- UX and UI inconsistencies

- Dead ends in the wizard where customers need help

- Ambiguities causing customer confusion and bounce rates

- Restructuring the user flow to reduce clicks and streamline the process for better comprehension and experience.

- Introducing consistent information hierarchies to improve understanding.

- Guiding customers at previous dead ends to prevent drop-offs.

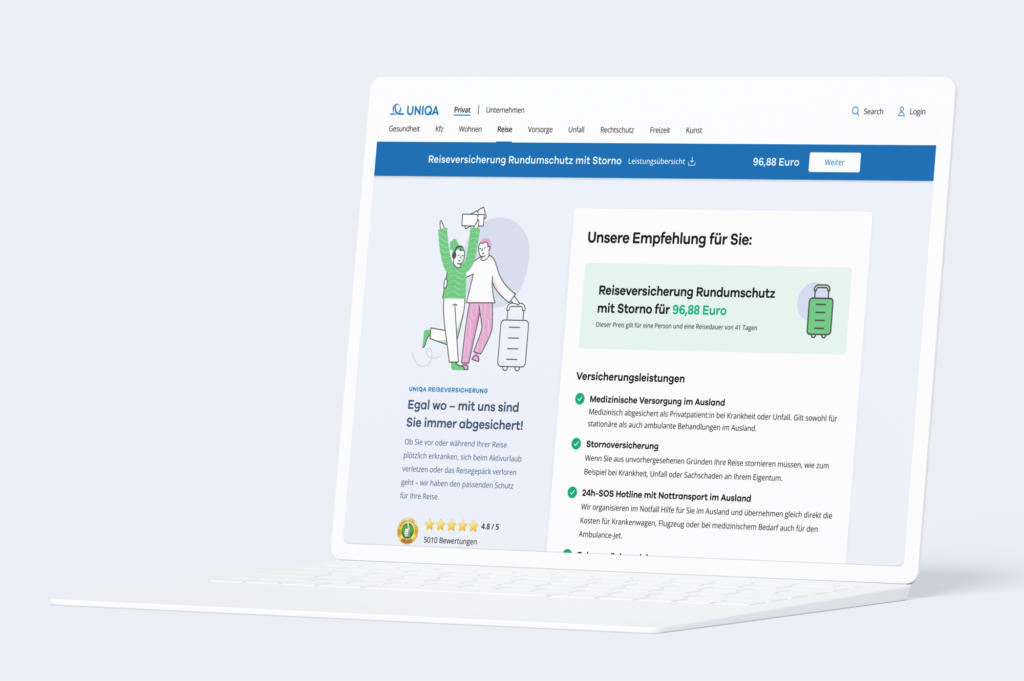

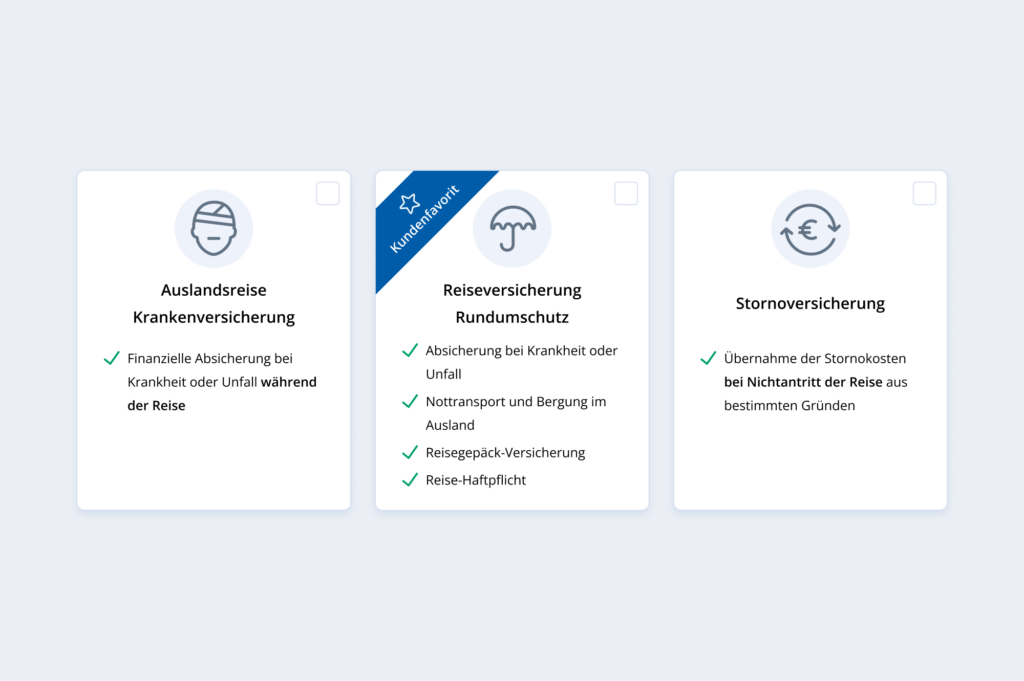

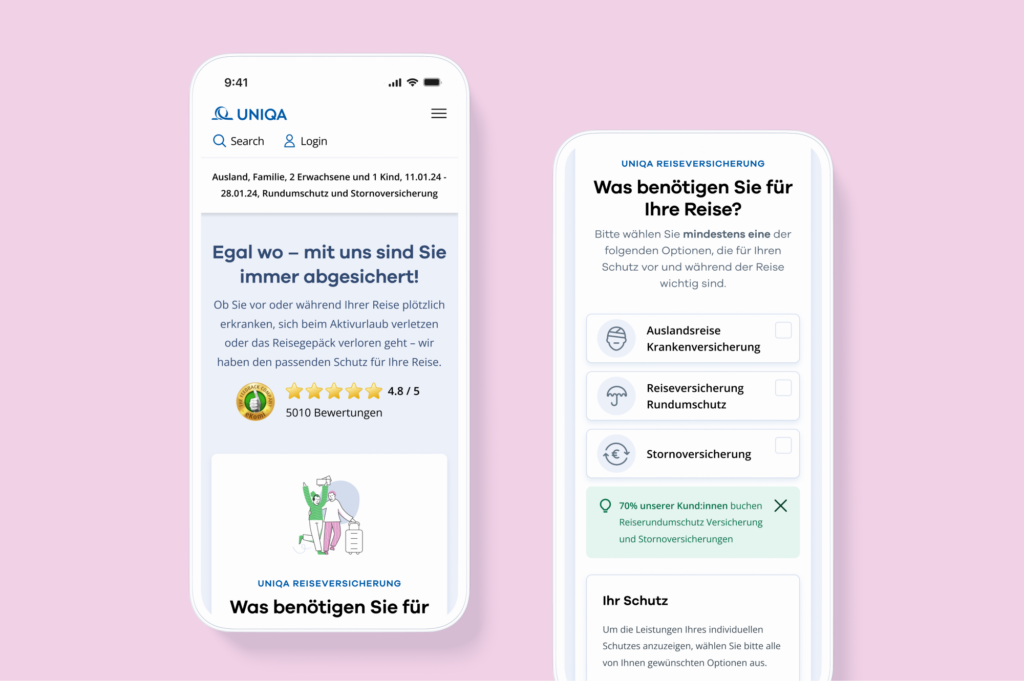

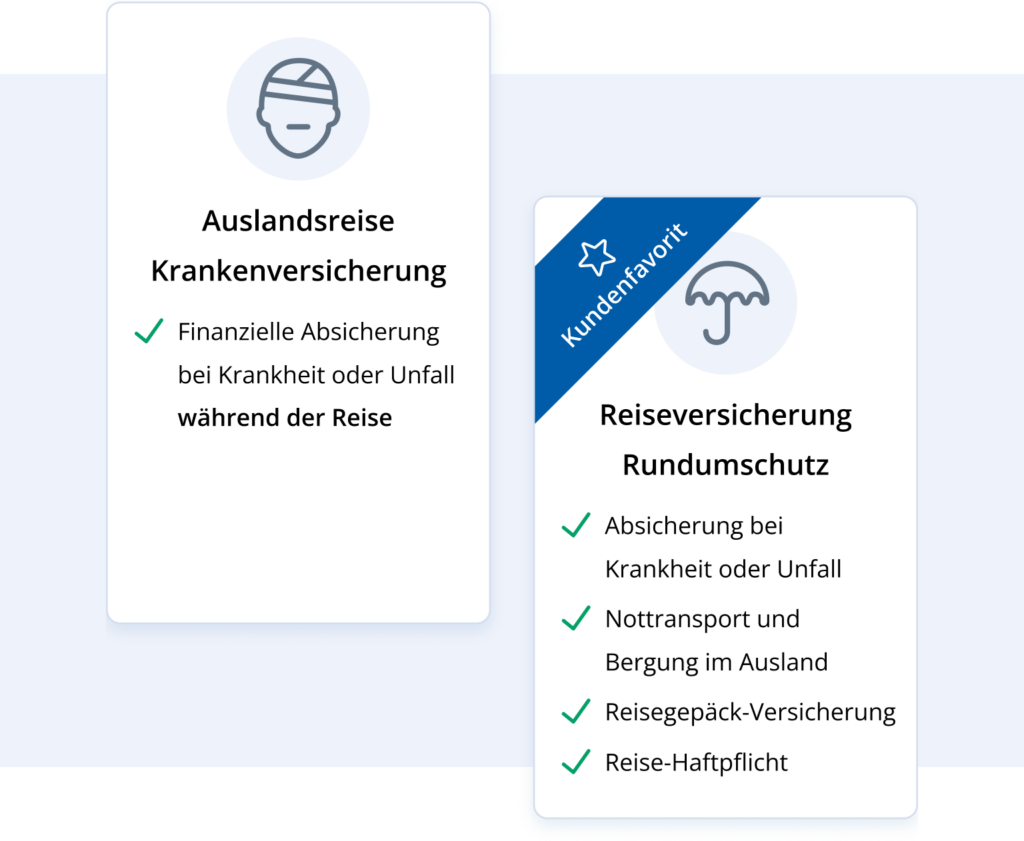

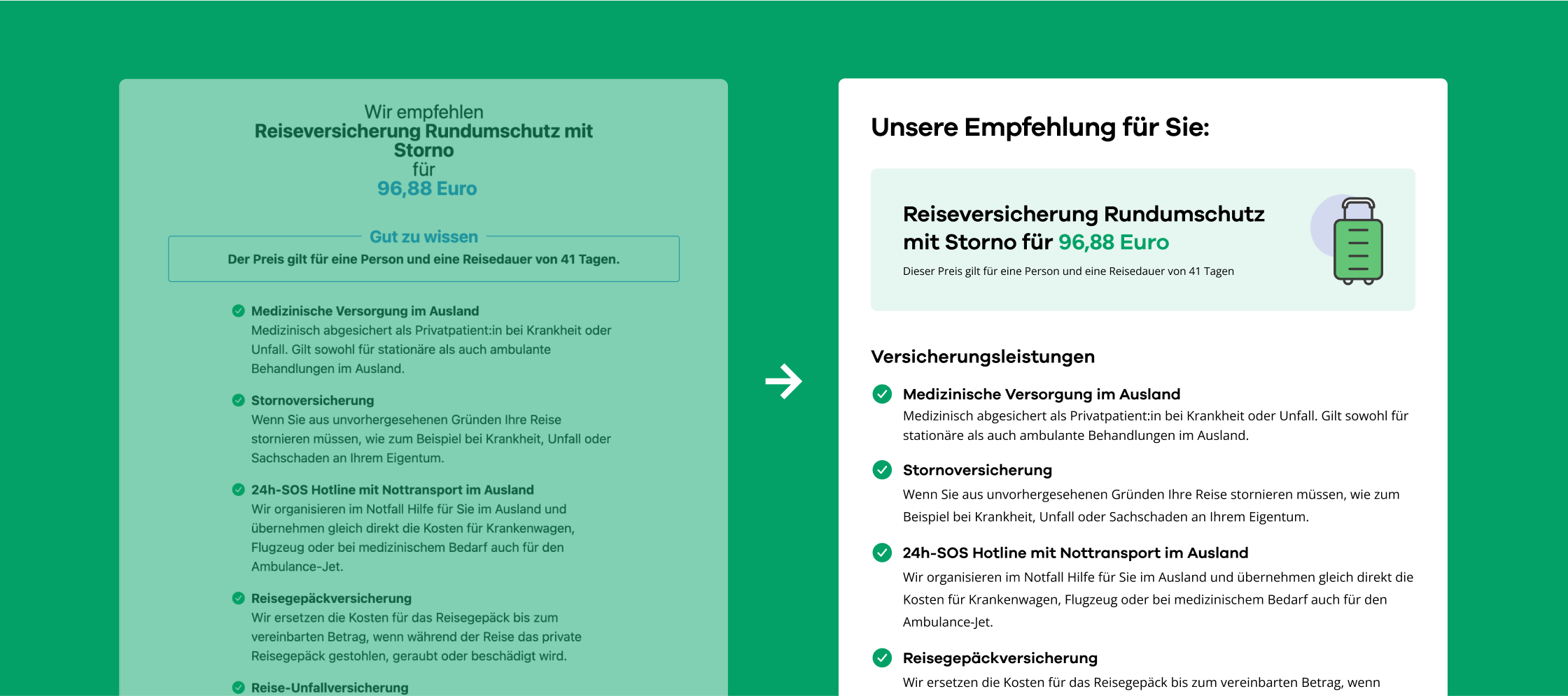

Product Selection

Customizable products with a dynamic overview of insurance coverage

Our work focussed in particular on the area of product selection itself, as this is the core area of the entire insurance route. In contrast to previous variants, we developed a dynamic input, which makes it possible to display, depending on individual choice, the insurance benefits a customer will and can receive. In this way, we increase the understanding of those benefits included in the package selected by the customer and those that can be added to it, and also highlight missing benefits.

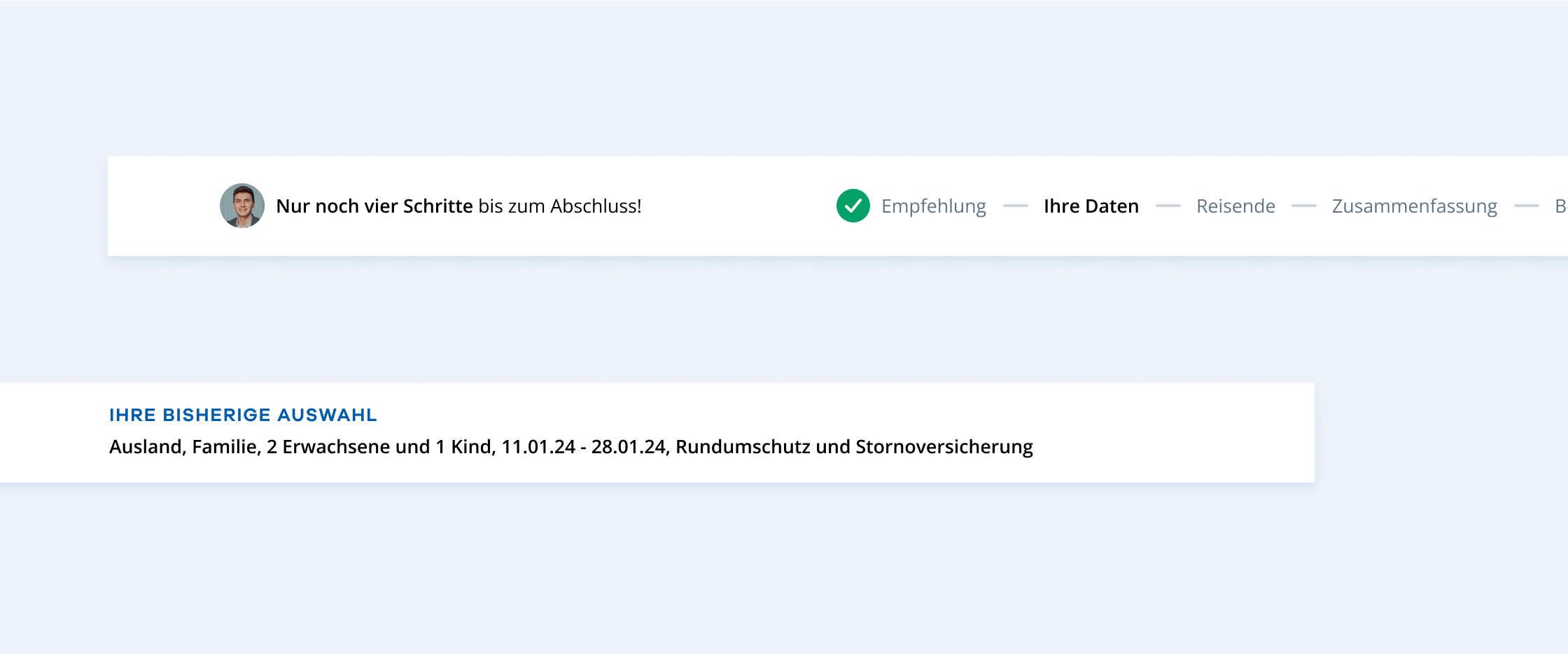

Navigation

An informative progress bar guides you through the funnel

The previous funnel version of the insurance journey was lengthy; causing customers to quickly lose track of where they were in the process and what selections they had already made. This issue has been addressed with the newly introduced progress bar. This feature allows customers to easily track their progress at any point in the process, see which inputs they have already made, and let’s them know how many steps remain until the product purchase is finalized.

Motion Design

Transitioning from static to dynamic via motion design

During the visual redesign of the travel insurance journey we introduced animated illustrations to deliberately break the monotony of the wizard. At the same time, we ensured that these animations keep the customer’s focus on completing the product purchase. The subtle, cheerful animations create an inviting feeling, revitalizing the seemingly dry nature of insurance and enhancing engagement with it.